- Infographics:

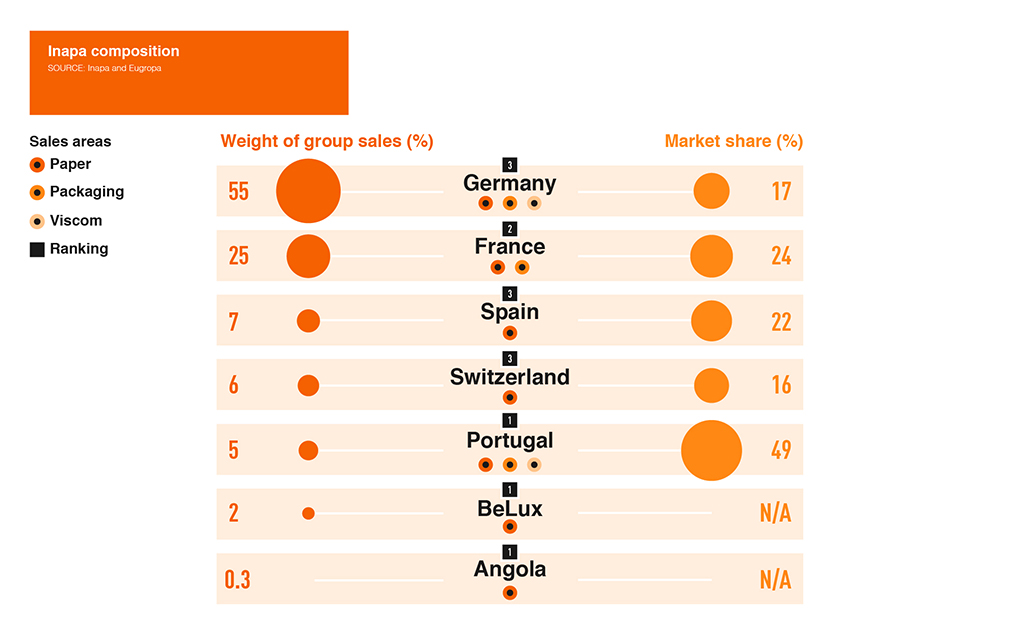

- Inapa composition

- |

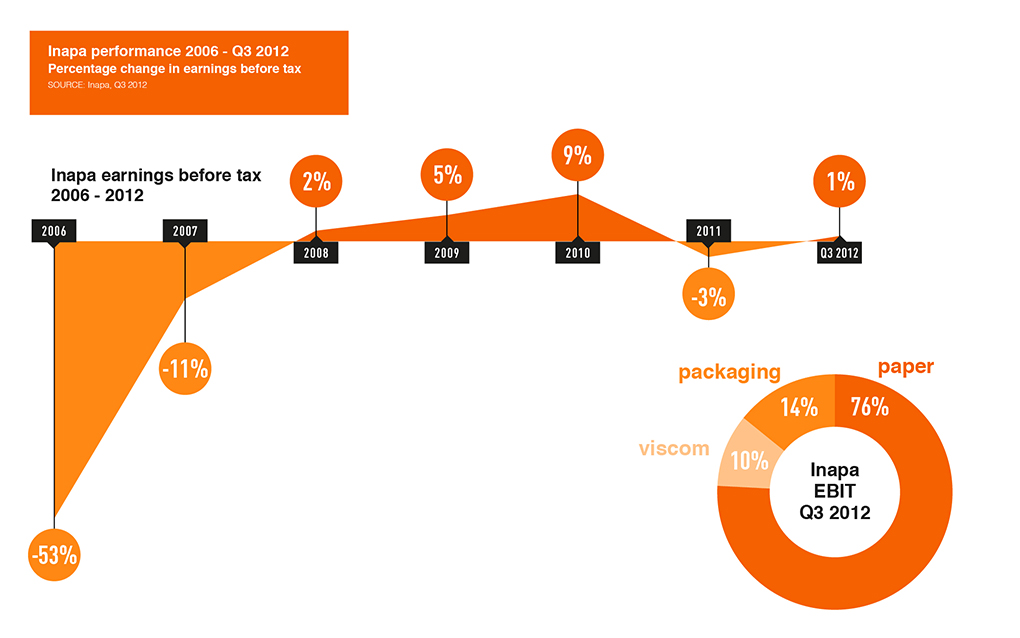

- Inapa performance Q3 2012

- |

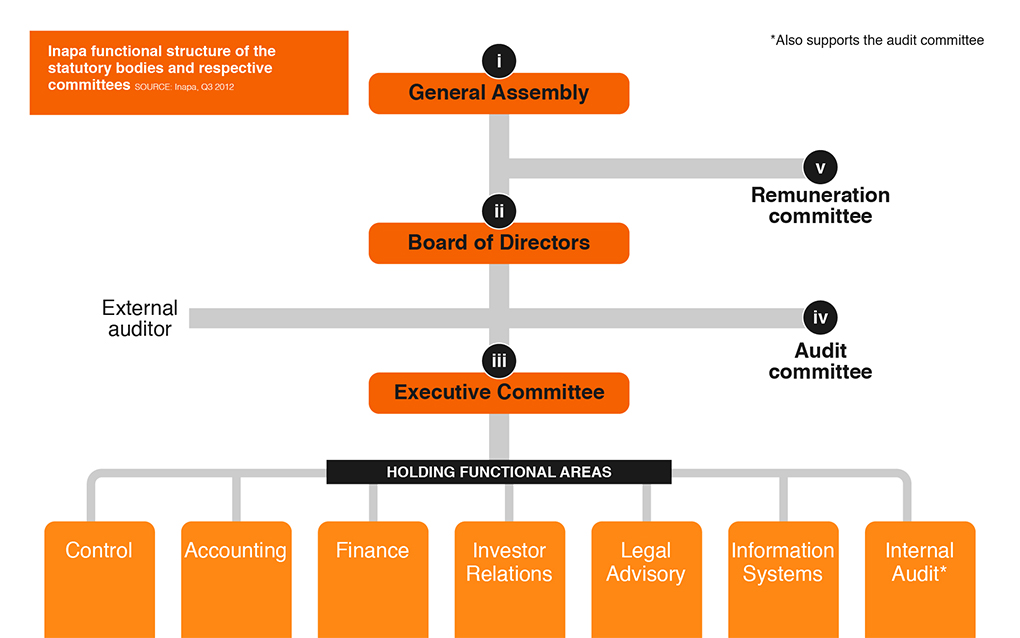

- Inapa's functional structure

- |

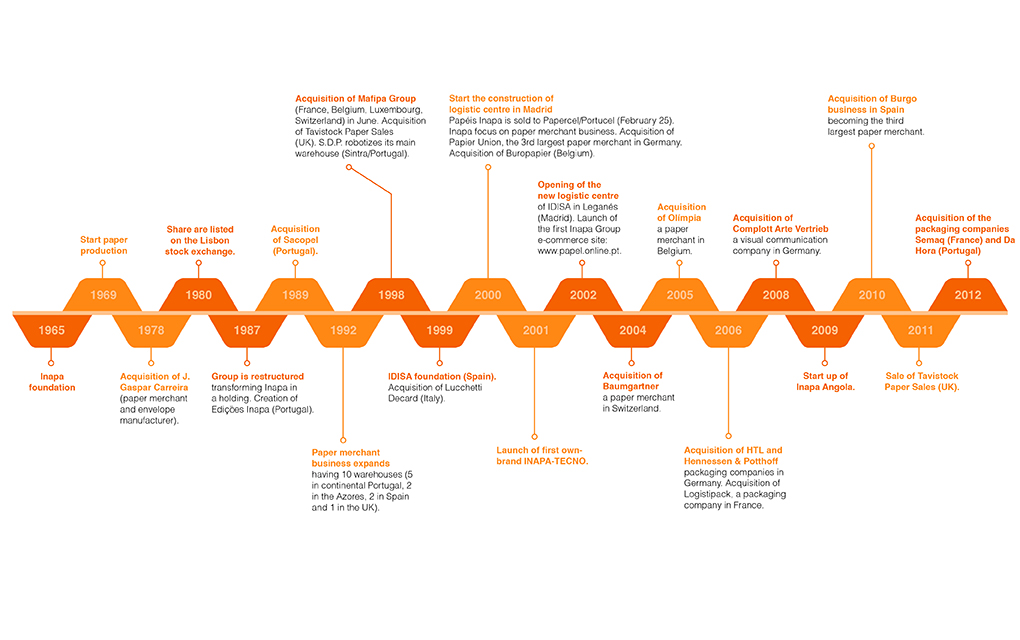

- Company timeline

- |

An exceptional example of good corporate governance in Portugal, Inapa has matured into a successful pan-European company, a leading paper merchant with expansionary plans. Inapa sells almost 900,000 tonnes of paper annually, made up of more than 12,000 products, to eight countries and generating almost €1bn in sales. It also has enterprises in the packaging and visual communication markets, which are progressively expanding.

Inapa has been awarded the title of Best Corporate Governance in Portugal three years running by World Finance, demonstrating its strengths in transparency, communication and continuing efforts since its governance restructuring in 2007.

Inapa has come a long way since it was founded 50 years ago as Portugal’s first large-scale paper factory. The company’s focus has since shifted from production to distribution, making it one of the largest paper merchants in Europe.

In 1969 Inapa began its activity as a paper producer, being the first large scale factory in Portugal.

In the following years, Inapa grew, first through the acquisition of a Portuguese paper distributor and envelope manufacturer, later by the admission in the Lisbon Stock Exchange, and in the following years, through acquisition and foundation of several other companies.

In 1998 Inapa acquired the Mafipa Group (France, Belgium, Luxembourg and Switzerland) and Tavistock Paper Sales in the UK. On the following year, the Spanish company is founded and Lucchetti Dechart (Italy) is acquired.

The turn of the millennium saw Inapa sell its industrial assets in paper production, focusing in the paper merchanting business. 2000 also saw the first of many acquisitions: Papier Union, Germany’s third largest paper distributer, a pivotal move that established them as the leading paper merchant in Germany. In 2001, Inapa launched its first own brand product for office papers, Inapa Tecno, which has since diversified into 15 product types.

The past decade has seen the Inapa empire grow, which has naturally seen the group reconstitute issues relating to its corporate governance in Portugal. Acquisitions include Swiss merchant Baumgartner, Belgian merchant Olympia, French merchant Verpa and Burgo distribution business in Spain. The company has diversified into distribution packaging and visual communication, which now make up more than 20 percent of operational results. This has been achieved by acquiring a set of profitable companies: German packaging companies HTL and Henessen & Potthoff, French packaging companies Logistipack, Semaq and Karbox, German visual communication company Complott Art-Vertrieb, Portuguese packaging company Da Hora and Viscom company Crediforma.

2009 also saw Inapa’s first venture outside of Europe: Inapa Angola.

As a result of the group’s effective corporate governance in Portugal, Inapa’s share capital consists of 150m ordinary shares at a €1 issuing value and over 300m preferred shares that hold no voting rights with an 18 cent carrying value. As each share holds one vote, Parpública the state-run holding company, currently wields the highest voting power with thirty three percent of voting rights.

The sale and distribution of paper represents about 90 percent of Inapa’s turnover. In this segment Inapa complements the offer of paper products with the supply of consumables for the printing and office industry and logistics services. Proficient logistics allow Inapa to prosper in distribution. Thanks to 300 trucks and 27 warehouses, Inapa ensures 24-hour delivery, allowing for 5,000 deliveries a day.

Inapa diversified in 2006, investing in the packaging business. 2008 saw Inapa diversify further by expanding into visual communication.

Packaging materials are distributed by seven dedicated companies in the Inapa group: the German HTL Verpackung and Hennessen & Potthoff, French Carton Service, Semaq and Karbox, and Portuguese Da Hora and Inapa Embalagem. Inapa offers a wide range of products extending beyond their specialities of paper and cardboard, such as plastic bags, films, tapes, strapping, foam and pallets. It also provides personalised and contract packaging solutions.

The acquisition of Complott Art-Vertrieb in 2008 marked the beginning of Inapa’s venture into Viscom: the business segment with the highest rate of growth within graphics. The expansion has proved successful with Complott performing positively thanks to digital signage printing subcontracts with numerous advertisers. In 2013 Inapa acquired Crediforma, a Portuguese company, beginning the expansion of Viscom business to other European countries.

Inapa currently operates in Germany, France, Spain, Switzerland, Portugal, Belgium and Luxembourg and has expanded to Angola in 2009. The group has proven itself by ranking in the top three paper merchants in each country. The German and French markets account for 80 percent of consolidated sales, with Inapa’s broad reach meaning it has had to facilitate the very best corporate governance in Portugal in order to enable shareholder confidence across the group.

Inapa’s German market is the biggest business unit and is strong in all three group areas. In the paper business, Inapa operates through Papier Union, a reference player in this market. The group also has operations in this market on packaging, through Henessen & Potthoff and HTL, and on visual communication, through Complott.

Inapa France is the group’s second largest distributor, accounting for 25 percent of sales. As national leader of the office paper segment, Inapa ensures full coverage of France from seven logistics bases. The group also operates its packaging business through Carton Service, Semaq and Karbox, the latter being one of Inapa’s latest acquisitions. Inapa France also operates affiliates in Belgium and Luxembourg: primarily focused on the office segment.

In its home country of Portugal, Inapa is the largest paper distributor, with a market share of around 50 percent. 2010 saw Inapa expand into the packaging segment and further consolidate its growth, with the acquisition of Da Hora. Already in 2013, into took another step, entering in the visual communication market, with the acquisition of Crediforma. Operating its corporate governance in Portugal means that home nation values are still instilled throughout Inapa.

Thanks to the acquisition of Burgo Group in Spain in 2010, Inapa has consolidated its position as Spain’s third largest paper distribution business. The Group serves this market using its three logistics platforms and offering a very comprehensive range of products.

Inapa Switzerland is the result of the merger of three paper merchants with the group introducing an innovative online platform to serve the office segment, helping it to acquire a 16 percent market share.

Inapa was the first paper merchant with a permanent establishment in Luanda, Angola.

Inapa’s mission is to provide value through the distribution of tailored offerings. This has been cemented through its corporate governance in Portugal coupled with its short to medium term strategic plan.

Having already completed the adjustment process in order to improve the profitability and sustainability, INAPA now will focus on:

Environmental sustainability is one of the cornerstones of Inapa’s corporate culture, as it should be in corporate governance in Portugal. The firm promotes environmentally friendly initiatives, such as renewable energy and effective waste management solutions and ensuring compliance with environmental management standards. Inapa ensures its paper supply chain is eco-friendly, from forests through to manufacturing and distribution and is in the process of implementing a set of initiatives to offer customers efficient waste management solutions. The group have also included Environmental Performance Indicators on the back of every pack of its own brand paper Inapa Tecno to demonstrate to customers their environmentally-conscious approach. The EPI contains information on the origin of the raw materials, the majority of which are from sustainable forests, and the production-related CO2 emissions, water pollution and waste generation involved with production.

When it comes to corporate social responsibility, Inapa includes solidarity initiatives across the group to ensure a valid contribution towards the achievement of a sustainable, fairer and more balanced future. Inapa makes in-kind donations to several institutions each year, in Belgium donates funds to the Belgian Cancer Foundation for each pallet of Guardian Paper sold and in France has protocols with two companies that employ people with disabilities that provide maintenance and recycling services. In strictly adhering to this strategy, Inapa has shown itself well positioned to be awarded the title of Best Corporate Governance in Portugal, 2013 by World Finance.

A movement at the General Assembly of Shareholders in 2007 meant that an administration and supervisory governance model was introduced to ensure effective management levels. The model is headed by the Board of Directors, with the introduction of an audit committee to supervise the quality and integrity of external auditors (PwC) in order to maintain fair corporate governance in Portugal.

The Board, consisting of five non-executive members and three executive members, presides over strategy and policy, delegating matters to an Executive Committee, who review subsidiary operations and assure the implementation of the strategy defined by the Board. The Committee consists of CEO, CFO and COO. This strong governance structure has enabled Inapa to exercise excellent corporate governance in Portugal.

Another result of the 2007 shareholders meeting was to enforce a set of key principles entailing the rights and duties of employees, customers and shareholders. These consisted of: